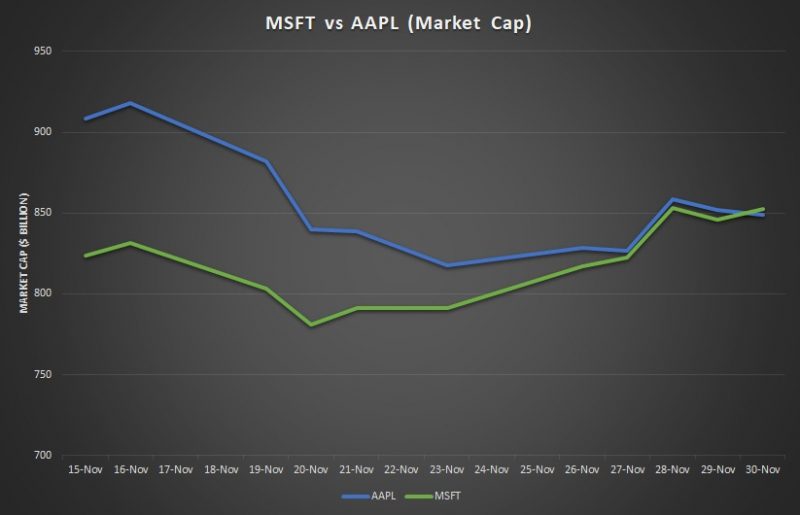

The players Microsoft and Apple have been in the limelight since past few years. In the battle for the world’s largest cap. Both the players have been trading back and forth for the title of the dominant player.

But according to a deal closed in Dec last year, Microsoft held an implied market valuation of $851.2 billion at $110.89 per share, based on an outstanding count of 7,676,218,736 shares as of Oct. 19, according to the company’s most recent SEC filing.

As per Apple’s market valuation, based on an outstanding share count of 4,745,398,000 shares as of Oct. 26, lagged just behind at $847.4 billion, at $178.58 per share, leaving less than $ 4 billion between the valuation of the two tech companies.

However, They’re both right around $850 billion in market cap. They’re comparable. Whoever’s in the lead just depends on when you’re checking the quotes. They are basically neck to neck right now.

Even though they are quite close at market value, Microsoft is trading at about 45X earnings compared to Apple’s 15X. That’s a pretty crisp contrast with respect to the underlying earnings valuations between the two companies.

The probable reasons for Apple’s decline could be:

- Expensive pricing models.

- Single point focus on a falling demand of the product

- Lacking diversification in the business model

Apple vs Microsoft:

The neck to neck competition for the world’s largest Market cap

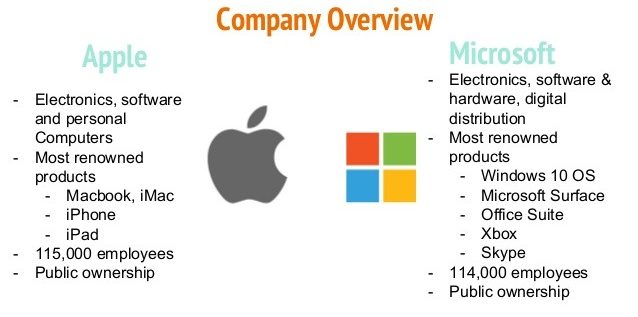

Apple

Trailing back to history, as per The NewYork Times the era ended with the beginning of a new one when Microsoft had dominated the market place for over two decades is surpassed by Apple in 2010. The last time when Microsoft and Apple had indistinguishable market caps was when Apple first surpassed Microsoft’s market cap, Steve Jobs was still alive.

However, Apple was not able to maintain the crown seat in marketplace losing its the spot. All was quite new for us and for others too. But every new thing if not updated becomes old.

The fundamental mechanism lies in the difference between their industry and core products. Apple is a hardware company and it’s the majority of the turn over worth 60 % of the entire revenue comes from the iPhone sales. The mere incredibility for Apple lies in the dependability on the single core product and witnessing the absence of sub integration of variable sectors.

Although a single product with a new and creative framework business model is always approachable during the launch phase. This may be somewhat lingering off the initial phase to stretching it’s a timeline to the era where the majority of the consumers get used to it and expect more of it in terms of functionality.

Probably the same mechanic happened when Apple refused to reveal the real production units for the iPhones,iPad, and mac while witnessing it’s painful weeks, reducing transparency to investors. The probable reason for non-disclosure of the unit counts could be the production of fewer units based on a few personas of potential buyers. Unless you get something more features in terms of functionality, the buyer market is likely to fall drastically. The same happened with Apple too.

On the forefront, Japan as of now is the biggest market for Apple, representing 8% of the total revenue as of the most recent reported quarter. In addition to that, Apple had already lost it ’s market share in China as well as the rest of Asia, while Europe is just flat and North America is down.

Even for Japan, the demand is slowly getting killed. The main issue detected being able to get the same featured model from the variable markets under affordable prices. Due to a decrease in demand, the telecom companies are demanding higher subsidies to offer iPhone in their network and stores, while maintaining their share of profit.

The other fact being the price range, due to the limitation to the diversification in the production of core products, Apple has always maintained the expensive price range. The pricing effect quadruples when the product is dispatching outside the US depending on the exchange rates.

Taking instance for India, If a mac pro costs for $10,000 then Indians would be summed up with a price range of 7 lacs (approx) for a single piece. How many can afford this? The promotional caption raised by common man donating the liver to get an Apple product holds tight here.

Microsoft

Being a software company, Microsoft stocks has tripled in the past four years under the leadership of CEO Satyajit Nadella. The growth has been such tremendous to have surpassed the parent company Google by market cap. Microsoft’s closing price reached an all-time high of $115.61 on Oct. 1, 2018. The reason is a much larger platform with more diverse users and products across platforms, it would make for a better choice for investors to adopt the more universal service for point-of-purchase transactions.

We all know before surfacing the mainstream, Microsoft was mostly a software company, having installed their products in variable manufacturing platforms like Dell, Hewlett Packard, Samsung with a diversified price range.

.In annexation to the core services, Microsoft under the vision of Satyajit Nadella had already started spreading their wings to focus on cloud services with Microsoft Azure against their main rival in this sector, Amazon in cloud computing. One more thing we can demarcate here is when Apple is more focused on the paraphrasing that one creatively invented product of Steve Jobs, Microsoft happens to play the dice on the services and technologies of the future.

Microsoft has impressible widespread business models as compared to its contemporaries. The statistical is apt to know that Windows, Xbox, and Surface combined make up just 36 percent of Microsoft’s entire revenue, compared to 86 percent of Google’s revenue comes from advertisements.

One of the major cash cows for Microsoft has been the launch of the Office Suite 365 back in 2011 making it as a service business. generally speaking, investors love subscription business as it is recurring. After all, Fortune 500 companies are going to continue to pay for the Office Suite.

The only one fall back is being addressed too. Microsoft failed remarkably in the mobile sector with its Windows Phone efforts, but the company has shown it’s resilient.

Microsoft is clearly filling the gaps through cross-platform technologies, the cloud, artificial intelligence, and is aiming to securely aim for the probable future demanding services of quantum computing and mixed reality computing. The creativity garnered by Microsoft is actually getting it more in terms of market expansion and revenue share and valuation.

So summing it up, Who do you think would be more successful in the long run Microsoft or Apple, Let us know in the comments down below.